This post is also available in:

עברית (Hebrew)

עברית (Hebrew)

Turns out the Russian military is full of US-made microchips and other tech, which is being rerouted to Russia by other countries. So, although unintended, US tech is currently fueling the fight on both sides of the Russian-Ukrainian conflict.

In sharp contrast to the sanctions imposed by the US following Russia’s invasion of Ukraine, the analytical center of the Kyiv School of Economics recently recovered Russian military equipment that has over 1,000 foreign-made components, most of which are semiconductor technology used in the West.

The US and its allies imposed sanctions to isolate Russia and prevent it from using the money generated from trade for the war against Ukraine. Part of these sanctions was limiting technology access to Russia in order to weaken Russia’s aerospace industry and its military, and despite the Russian airplane industry immediately being affected, it mysteriously kept on working, and now we know the reason why.

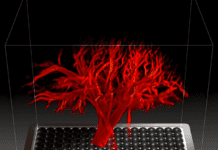

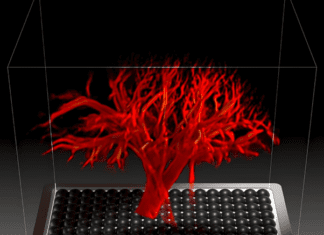

Microchips, for example, are ubiquitous in electronic appliances these days and are also used in military tools like drones. It is therefore difficult to know whether a chip sent to Russia will be used for civilian or military purposes.

Apparently, more than two third of the components used by Russia in its military equipment originate either from companies in the US or from allies like Japan or Germany, and it is currently unclear whether the companies were aware of where their goods were heading.

A possible reason for this is that global trade often involves selling and reselling goods by legitimate businesses in various countries, and even if the US and its allies have imposed some sanctions, other countries worldwide are still trading with Russia. It seems that Russia is leveraging its trade relations with neutral nations to get its hands on Western tech.

According to Interesting Engineering, China alone supplied 87% of Russian semiconductor imports, but more interestingly, over half of these goods were not even made in China but only made a stop on their route to Russia.

Given their wide application, semiconductor supply chains are complex to track, but in an effort to deal with this issue, the EU released a list in June 2023 detailing 87 companies in China, Armenia, and the UAE that are acting as Russian intermediaries.